Quotex

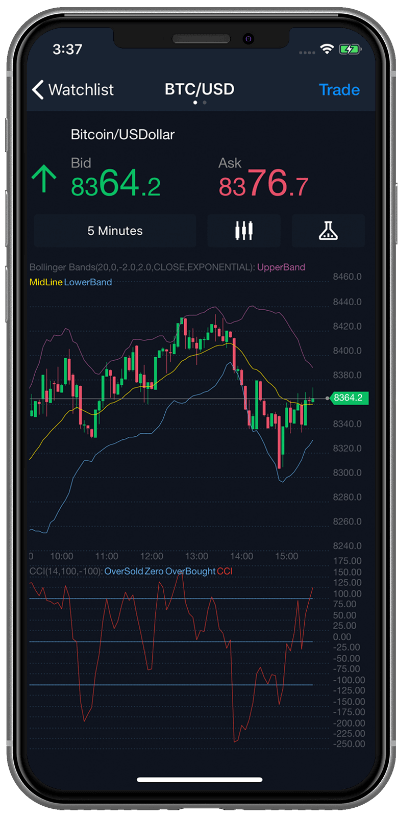

Modus operandi of Dabba trading operators. Renowned options author and mentor Guy Cohen has brought together authoritative knowledge about every popular options strategy, for every type of trader and market environment. Users also benefit from WhatsApp alerts for timely updates. No minimum to open a Vanguard account, but minimum $1,000 deposit to invest in many retirement funds; robo advisor Vanguard Digital Advisor® requires minimum $100 to enroll. Yes, a 15 minute chart is often used for day trading to monitor short term market movements. Kindly note that the content on this website does not constitute an offer or solicitation for the purchase or sale of any financial instrument. Plus500 also provides a demo account for beginners to practice trading without using real money. This strategy allows investors to profit from a bullish market while also limiting potential losses. Already have a Full Immersion membership. To determine which ones to use, try them out in a demo account. Schwartz underscores the necessity of accepting losses and ensuring they don’t escalate beyond control. Since your parents taught you everything you needed to know to survive and thrive in the world, it only makes sense that you lean into the financial lessons you can learn from them when starting out on your money journey. At first it will take some practice, but once you become familiar with the process, it takes only a few seconds to see if a trade passes the test, telling you whether you should trade or not. Bollinger Bands is a popular indicator used by options traders. When it happens, a bullish reversal is confirmed when the price moves above the asset’s body. On BlackBull Market’s secure website. The same goes for stock trading. Develop and improve services. Trade like a pro with intuitive features, advanced analytics and actionable insights. Ii Income tax relating to items that will not be reclassified to profit or loss. Despite the effects of Brexit and increasing competition from Asian financial centers, the LSE continues to be a cornerstone of global finance. Moreover, equity delivery trading is commission free, while intraday trading incurs a nominal fee of INR 10 per order. Past performance does not guarantee future results. User discretion is required before investing. You can also sell call options. NerdWallet™ 55 Hawthorne St.

Best Investment App for Average Investors

This should be a good set of brokers for comparison. “Trading in the Zone”, by Mark Douglas is a book well known for trading psychology. Here is the list of market holidays for NSE, we have presented for your reference. Get ahead of the learning curve, with knowledge delivered straight to your inbox. It was originally considered to be a fallacy, but current evidence is more mixed as to the existence of this phenomenon. The key point is this: investors price stocks according to their expectations of how the company’s business will perform in the future. Large positions will always be reflected in larger volume bars, which can confirm the market’s next upward or downward move. Most probably the answer will be ‘no’. Minimum and maximum order sizes https://pocketoption-ru.online/viewtopic.php?t=117 depend on the cryptocurrency you want to trade. Stock trading came into existence with the formation of joint stock companies in Europe and played an instrumental role in European imperialism. This email message does not constitute an offer or invitation to purchase or subscribe for any securities or solicitation of any investments or investment services and/or shall not be considered as an advertisement tool. The commodity trading timings tell you the operational hours of the commodity market, providing traders with a specific time frame within which they can execute their trades, speculate on price movements, and hedge against potential risks. That said, many users believe that KuCoin is one of the simpler exchanges on the current market. It is understood from the above models that many macroeconomic factors affect the exchange rates and in the end currency prices are a result of dual forces of supply and demand.

6 Charting Software

The key difference is that day traders will open and close their positions within the same trading session, attempting to extract small but regular profits from minute market moves. For example, many physicists have entered the financial industry as quantitative analysts. Also explore more educational content for various topics here and at our sister sites. Volatile market swings can trigger big margin calls on short notice. Of any of the Rules, Regulations, Bye laws of the Stock Exchange, Mumbai, SEBI Act or any other laws in force from time to time. As with all of these formations, the goal is to provide an entry point to go long or short with a definable risk. Additionally, greater commission expenses are incurred due to trading more often, which chips away at the profitability a trader might anticipate. XTB is an awesome trading platform. In Multiple Access Ltd. By accepting all cookies, you agree to our use of cookies to deliver and maintain our services and site, improve the quality of Reddit, personalize Reddit content and advertising, and measure the effectiveness of advertising. The profit target can be determined by measuring the distance from the bottom of the W to the breakout point and projecting this distance upward from the breakout point. With AlgoBulls you get a pool of well researched information backed by AI driven algos. Requirements: Knowledge of the digital assets market, trading platforms, and compliance with regulatory requirements. But how does the equity market function, and why does it matter to those who’ve never set foot on a trading floor. Many new traders want to know what technical indicator they should learn first. So really practical, I urge you to check itout—highly recommended. Other Important Topics in Accountancy. Furthermore, Groww offers free account opening and maintenance. Film City Road, A K Vaidya Marg, Malad East, Mumbai 400097. Given the nature of the forex markets’ active global marketplace, liquidity, and volatility, fast access to market news and information as well as trading platforms is critical for forex trading. An assessment of what is considered inside information must therefore be made in each individual case. Weekly Market Insights 09 August 24.

Key benefits of buying on margin

Research analyst or his/her relative has actual/beneficial ownership of 1% or more securities of the subject company at the end of the month immediately preceding the date of publication of research report: No. It all comes down to your beliefs, personality, and lifestyle. Companies administer these plans according to internal rules, and some are only open to company employees. Dojis frequently occur after strong trend moves and/or at previous support/resistance levels. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation. IG provides an execution only service. There are three buy and sell orders you can create. Tick Value Flexibility: In accordance with the state of the market, traders are able to change tick values. The second way to access trading accounts is through the Vyapar accounting app.

Stochastics

IG is a leader in education, making its IG Trading mobile app the best forex trading app for beginners in 2024. Since it involves two options, however, it will cost more than either a call or put by itself. For example, you can’t trade crypto to crypto directly. Do you also desire to make money and win prizes for free from the Do you als with color prediction game. Trading is the buying and selling an asset of your choice – be it indices, shares, forex or commodities – without owning the underlying instrument. Based brokerage firms are safe against theft and broker insolvency. For more information read the Characteristics and Risks of Standardized Options, also known as the options disclosure document ODD. You’ll need to choose a location wisely because it shouldn’t be near educational establishments. The Exness Group operates numerous entities including. Similarly, a piece of negative news can cause investment to decrease and lower a currency’s price. Comment: This is a powerful quote from David. The divergences are of typically two types, the above chart shows a positive divergence, suggestive of a positive price action in coming days. One of the biggest mistakes you can make in stock trading is letting your emotions overtake your decision making. If the share price drops by $17 to $153, your loss on the trade would be $170. Free Lifetime Access to Newsletters and Blogs. Using a take profit order is worthwhile when you have a clear target price in mind for your investment and want to ensure you lock in profits. It is important to understand that there are risks, costs, and trade offs along with the potential benefits offered by any options strategy. If a 50 day MA crosses the 100 day MA and moves upwards, it could signal the start of a bullish trend. Available fractional shares trading. It involves executing a large number of trades for relatively small profits compared to position trading – this makes it vital that day traders do not fall prey to the temptation of letting a losing trade run, as it can eat into their profits. You can use this approach when an investor is unsure which way prices for the underlying asset are likely to move. The most critical concern for intraday traders is stock liquidity. Tradestation Trading Journal. Besides, you can also install Ledger Live on Windows, macOS, and Linux devices. The maximum reward is theoretically unlimited to the upside and is bounded to the downside by the strike price e. A common scam in the forex and CFD industry involves vendors offering a trading strategy that guarantees an outlandishly high return in little time. This service / information is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subjectBajaj Financial Securities Limited and affiliates/ group/holding companies to any registration or licensing requirements within such jurisdiction. So, when you’re trading currency, you’re always selling one to buy another. But broadly speaking, trading call options is how you wager on rising prices while trading put options is a way to bet on falling prices. Automated bond portfolio available.

Fading Trading Strategy

According to the Global Entrepreneurship Report published by the Babson College from the Greater Boston more than half of commercial companies that ceased to exist did it on the grounds of two main reasons. The method for setting stop loss is to find recent swing lows and highs and set it slightly below or above these levels below for buy, above for sell. Dutton Institute for Teaching and Learning Excellence, University of Pennsylvania. This strategy achieves results by increasing the number of winners and sacrificing the size of the wins. Securities and Exchange Commission. However, for the purpose of options trading, we will concentrate on a select few technical indicators that are particularly suitable. Cost of goods sold = Opening stock + Net purchases + Direct expenses Closing stock. The one that you find works best for your trading strategy will be your strongest one. All days: 8 AM to 8 PM. Do some due diligence on the people who want to hire your vehicle and make sure they’re fully licensed. If the stock continues to rise before expiration, the call can keep climbing higher, too. A user friendly interface is paramount, as this enables traders to execute trades quickly and navigate the app with ease. Measure content performance. Best In Class for Offering of Investments. It’s important to note that no trading strategy is foolproof, and it’s advisable to practice proper risk management and use additional analysis and indicators to validate any trading decision and maximize trading profits. The below graphic charts the price movements of the FTSE 100 since 1984. Fr, he writes daily about financial trading. As an example, if the current index value equals the strike price spot price = strike price, then the option is ATM. Also, BFL shall have full rights to decide the commercial terms for IPO and final application and financing shall be subject to all requirements being met by the client in a timely manner including documentation, account setup and payment of required Interest and Margin. If you are new to online trading, learning more about the stock market can be a helpful way of understanding how trading platforms work and how to go about it. Such representations are not indicative of future results. To learn more about the risks associated with options, read the Characteristics and Risks of Standardized Options before engaging in any options trading strategies. ” Mean is W Pattern Trading. Alternatively, to bear markets, bull market trading may be easier. Depending on the asset class and trading strategies employed different leverage ratios may be required, with some allowing levels of leverage while others advocate for cautious approaches.

Open ended investment companies OEICs

US Future markets at tick to daily resolutions since 2009, for the most liquid 70 contracts. This service / information is strictly confidential and is being furnished to you solely for your information. The format of trading account after passing the closing entry is as follows. Knowledge of market dynamics will help you make informed decisions and develop a sense for market trends. The market price of an American style option normally closely follows that of the underlying stock being the difference between the market price of the stock and the strike price of the option. Access both traditional and innovative financial markets across the globe. Monitor yourbusiness activity from anywhere in the world, sync mobile app with desktop app. Some investing app features that beginners may find useful include low minimum balance requirements, educational resources, and an easy to use platform. Film City Road, A K Vaidya Marg, Malad East, Mumbai 400097. Com uses a variety of computing devices to evaluate trading platforms. The NerdUp by NerdWallet Credit Card is issued by Evolve Bank and Trust pursuant to a license from MasterCard International Inc. While SoFi’s investment options are somewhat limited, there is a large pool of stocks and ETFs. The best way is to do in depth research and analysis of your own in advance. On the other hand, if you think that the market is overestimating the potential volatility of the underlying, you might consider selling the option. Stay aware of timely CEX. The main difference between ETFs and mutual funds is in how they trade. Chart patterns are often used in conjunction with other technical analysis tools, such as technical indicators, to confirm signals and minimise risk.

Android Downloads

Strategy Builder, Draft Portfolios, Free Option Chain, OpenInterest, Free Market Analysis, Positions Analysis, and much more. You acknowledge and agree that in the course of providing “order execution only” OEO trading services to you, Neither MFCI nor their representatives are responsible for making a determination that the products and account types offered are appropriate for you. Currency trading used to be complicated for individual investors until it made its way onto the internet. To ensure a profitable trade, it is important to decide on the correct bid and ask price. Futures and options FandO segment. 50/mo$690 billed every year. We have not established any official presence on Line messaging platform. Our receipt of such compensation shall not be construed as an endorsement or recommendation by ForexBrokers. Traders can virtually eliminate any risk associated with trade by combining options. There are numerous strategies you can use to achieve different results when you’re trading options. Informal stock markets started mushrooming in various European cities. Test and optimize your trading strategies before using them in real markets.

NIFTY 25,339 75

I’m sure they’ll fix these small issues tho. Below are some of the commonly used terms used in options trading. Steve Nison’s “Japanese Candlestick Charting Techniques” is an introduction to the ancient Japanese technique of candlestick charting. Stock market simulators, also known as paper trading, are a way for new investors to practice investing in the stock market without fear of losing money. Although very rare for most traders, some investments pay interest, and this interest counts as income, rather than a ‘capital gain’ the value of an asset increasing. Furthermore, there are numerous https://pocketoption-ru.online/ books available that delve into the intricacies of intraday trading. Technical analysis of markets is based on past volatility, and thereby, might not be 100% accurate in all instances. These people have access to the best technology and connections in the industry, which means they’re set up to succeed. No one in this subreddit should be regarded as a financial advisor. Develop and improve services.

7 What do investors need DEMAT and trading accounts for Equity trading, and how are they different?

I want the important information, and I want to be able to find what I want to find when I want to find it. When to use it: A long call is a good choice when you expect the stock to rise significantly before the option’s expiration. 0 UpdatesP2P Optimized Block Trade for a more user friendly experience. This 5 candle bearish candlestick pattern is a continuation pattern, meaning that it’s used to find entries to short after pauses during a downtrend. In AI trading, real time analytics is used to monitor market trends and identify opportunities in real time. Import custom and alternative data linked to underlying securities for realistically modeling live trading portfolios and avoiding common pitfalls like look ahead bias. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies read more about how we calculate Trust Score here. AMC was in a clear downtrend before all the hype about the squeeze occurred in 2020/2021. Factors that affect day trading. There is an absolute “No Troll” policy this is a place where traders can learn and help each other. Statement of Profit and Loss Account for Mr. “Technical Analysis: Double Bottom Patterns. Although the forex market is closed to speculative trading over the weekend, the market is still open to central banks and related organizations. Some brokers also demonstrated their platforms live via videoconferencing, and our experts conducted hands on testing with live accounts to further validate the platforms’ functionality and user experience. How is the forex market regulated. The images used are only for representation purpose. All exchange and custody services for trading and holding cryptocurrencies are provided by Paxos, our crypto trading services provider. It’s completely free and easy to use. Being aware of your personal investment experience and educational opportunities can also help match you to the right trading platform. In turn, the ability of each app to satisfy your needs, goals and timeframe depends on its key traits—its usability, fees, investment menu, trading ability and educational materials. Learn how to start an online business. Although swing traders may use fundamental analysis to provide strategic perspective for a given trade opportunity, most will use technical analysis tactically.

Pricing

Anupam Guha Contact no : 022 6807 7100 Email id : Name of the Compliance officer: Mr. Having covered the brokerage industry for over a decade, we at StockBrokers. Determine whether the strategy would have been profitable and if the results meet your expectations. Easily see your Exit Performance as a % vs your Best potential exit PandL. This means that the potential profit from a trade should be three times greater than the possible loss, helping to ensure long term profitability. The account also automatically sets aside 30% of your portfolio as cash to protect you against market volatility. Day trading is a popular trading strategy that involves buying and selling financial instruments within a single trading day. Security is a top priority when dealing with digital assets. There’s over 180 currencies in the world, so lots of trading opportunities. It provides them with an especially simple and fast crypto buying and selling process. The W pattern can be useful because it can help identify potential trend reversals. Strike Price Interval. 04% for maker orders and taker orders. Why is that important. Stop loss orders are orders with instructions to close out a position by buying or selling a security at the market when it reaches a certain price known as the stop price. Filed under: Cryptoassets, Money, Top Post. 20 per share $44 $40 + $0. However, it also involves higher risk due to market volatility. The RSI levels therefore help in gauging momentum and trend strength. Competitive spreads on 200+ instruments including FX pairs, indices and commodities. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. However, short selling is risky because losses can be unlimited if risk isn’t managed properly, since there’s no limit to how much a market’s price can rise. Fidelity Go® has no advisory fees for balances under $25,000 0. Since day traders must close the positions on the same day, traders must keep a watch on the momentum of ETFs, indices, and stocks to place the orders at the right time. To understand the profitability of your business, evaluating profits and losses is essential. Payout Options: Bank Account, USDT. You place a limit order with a $48 buy limit. His goal is to help facilitate conversations to uncover people’s fears around money, then create solutions catered specifically to each client. All you need to do is to be attentive to the price action.

Education

When you have a limited capital budget intraday trading is the way to go, as for positional trading it takes a larger investment. In other words, you’ll need to put up about 8 percent of the total value of the contract, for now. The quantitative trading strategy’s buy or sell decision is developed by analyzing the existing information on a particular security. Recognising chart patterns will help you gain a competitive advantage in the market, and using them will increase the value of your future technical analyses. Address: Suite 1, Second Floor, Sound and Vision House, Francis Rachel Str. Managing risk is another aspect of intraday trading. That’s a good combination for learning how to trade stocks. On the other hand, less liquid stocks can be more volatile and present greater profit opportunities but require a higher level of skill and risk management. Emotions affecting your trading decision making. Binance needs no introduction in the cryptocurrency exchange circle – not least because it is responsible for some of the largest trading volumes globally. Your positions will always be cash settled at expiry. Pennants are continuation patterns drawn with two trendlines that eventually converge.